Phase 3

Budgeting & Finance

- Estimate your project budget

- Understand the types of financing available

- Know how an ADU might impact your property tax assessment and home value

Your budget is one of the most important parts of your ADU project. You will need to balance design with what you can afford, but also consider potential rental income. Assess your finances early on, after you’ve learned what you can build and before you hire and start working with a design team.

Timeline

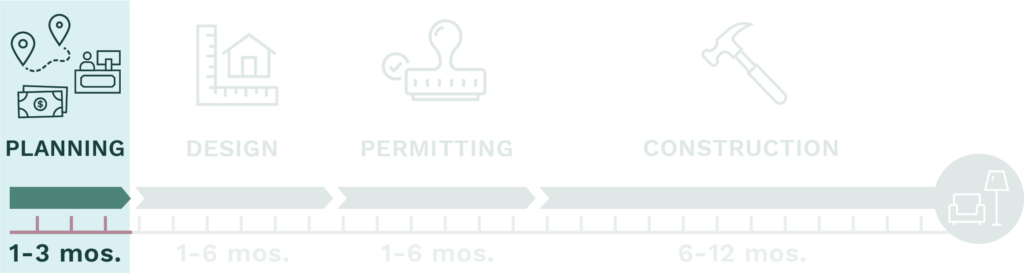

Budgeting is part of the Planning phase, which typically takes 1-3 months. Most ADU projects take 12-18 months to complete, but some extend to 24 months or more.

Frequently Asked Questions

Here are a few of the most frequently asked questions about budgeting and finance. See the content below and your County’s ADU Guidebook for more guidance, resources, and tips for all steps of the process.

Your County ADU Calculator is a great place to start when developing a budget. It provides a rough estimate of costs and income and will help you understand how choices can impact your budget over time. In general, it is helpful to avoid having a fixed budget total in your head as you explore your options. The cost to build an ADU typically ranges from $30,000 for a simple interior conversion JADU, to $400,000+ for a large detached ADU with high-end finishes on a hillside lot. Cost per square foot is a good way to estimate, though this too can vary — a very rough placeholder for you to use is $300 range per square foot for construction (“hard costs”) and design and fees (“soft costs”), depending on your design and the materials you chose.

See more details about costs – including design, permitting, and construction – in your County Guidebook.

Many homeowners use a mix of options to finance their ADU, including savings, funds from family, and/or loans. It is strongly recommended that your financing is in place before construction starts. Be sure to factor in potential rental income since that will help you repay loans. See your County Guidebook and Exercises for more details on financing options.

If you have equity in your home, a cash-out refinance or home equity loan/line of credit (HELOC) might work for you. Financing is typically unavailable for homeowners with lower income and insufficient home equity. The California Housing Finance Agency (CalHFA) ADU Program provides a grant of up to $40,000 to qualified homeowners for the reimbursement of ADU pre-development costs, including but not limited to impact fees. To qualify, a homeowner must be low or moderate income. Make sure to check if funds are available and if you qualify.

Adding an ADU will likely affect your property taxes and the resale value of your home. However, your primary house will not be reassessed, and your property taxes will only increase based on the added value of your ADU. For example, if you build an ADU that adds $150,000 to your property value, and your tax rate is 1%, your taxes will increase by 1% x $150,000, or $1,500 per year.

Building a JADU will have a significantly smaller impact on assessed value. In some cases, your taxes will not increase at all. Home sharing will also not increase the assessed value of your home. Generally, garage conversions will not raise your tax bill as much as new construction, but they will also not add as much value.

Each property will require a one-on-one analysis to determine the added value of an ADU, so contact your County Assessor’s Office once you have an idea of your plan. They may be able to provide you with a rough estimate of tax implications.

Adding an ADU may impact your income taxes as well. This can be rather complicated, and it’s best to discuss these with a tax advisor.

Usually not and you may need to record in a deed restriction for the property that the ADU cannot be sold separately from the primary home. Check County ADU Rules to find out what local restrictions apply.

Rental income is a major benefit of having an ADU or JADU on your property – for many people, it provides flexibility in their budget or an opportunity to grow their savings. Generally, you cannot rent your ADU for less than 30 days at a time (e.g., AirBnB, Vrbo). The County ADU Calculators can help you estimate how much rental income could be generated by your new unit.

To see translated Spanish FAQs, head to All FAQs.

Budgeting, Step-by-Step

Keep in mind that initial cost estimates are likely to change as you move through the process, and you won’t know what it will truly cost until you talk to a professional. Current workforce and supply chain disruptions are causing prices to move up and down more quickly than usual. If you have a tax or financial advisor, it is always good to check in with them early on too.

NEED FUNDING?

The Cal HFA ADU Program offers up to $40k for qualified homeowners to develop an ADU. Visit their website for more information.

Budgeting step 1

estimate your project cost

It is helpful to avoid having a fixed budget total in your head as you explore your options. Your County ADU Calculator is a great place to start when developing a budget. It provides a rough estimate of costs and potential rental income and will help you understand how choices can impact your budget over time. Your County Guidebook also has additional information to help you with this step, and our ADU Exercises provide some questions to ask and space to record your thoughts.

Keep in mind your plans might change once you hire a professional. On a more personal note, it’s a good idea to notify your neighbors about your project (not required but recommended), and to think about what it means to share space with tenants (and if that impacts your design and layout).

Helpful Tools

Budegting Step 2

Assess financing options

Many homeowners use a mix of options to finance their ADU, like their own savings and assets and/or loans. It is strongly recommended that you do not begin construction without your financing plan in place. Be sure to factor in potential rental income since it will be a source for repaying any loans. Your County ADU Calculator can help estimate income. Our ADU Exercises can help you assess your options.

Financing options include:

- Cash savings or other liquid assets

- Loans from family or friends

- Home equity

- Loans from a lender